Dillon Equation of Everything: Unifying c, ħ, G as Curvature Anchors via Predictive Refractance

Dillon Equation of Everything: Unifying c, ħ, G as Curvature Anchors via Predictive Refractance

as Curvature Anchors via Predictive Refractance

By Timothy Joseph Dillon

Inventor of Curvature-Based Computation

Technologist and Architect of Predictive Geometry and Symbolic Infrastructure

Abstract

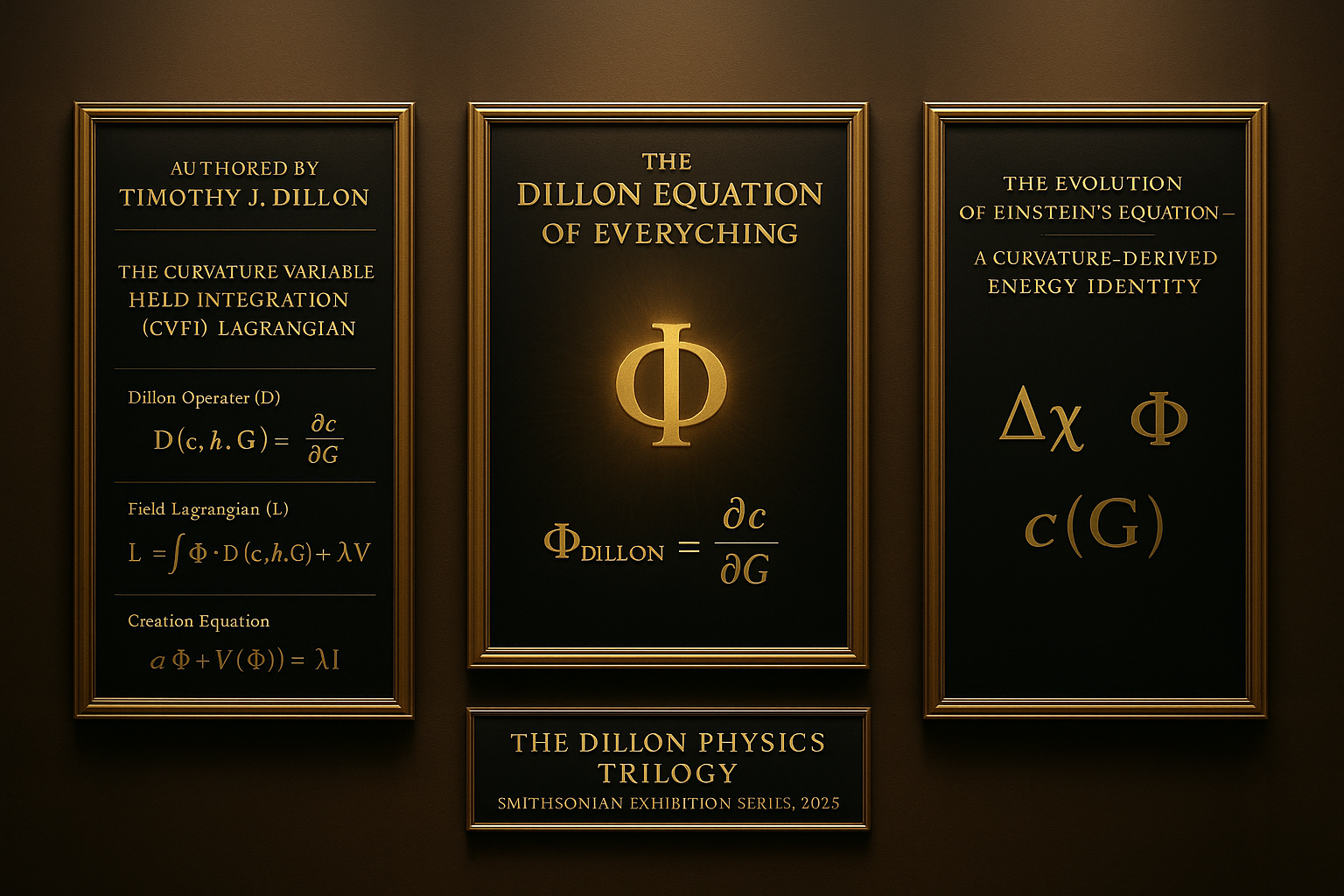

The Dillon Equation of Everything introduces a curvature-based domain operator unifying

the physical constants c, ħ, and G within a symbolic infrastructure of predictive refractance.

This operator governs the evolution of curvature, information, and consciousness as

interwoven fields. By coupling spacetime geometry to variable gravitational and refractive

potentials,

it establishes a domain where speed is no longer a boundary but an authored property of

curvature itself.

Introduction

The Dillon Equation reinterprets relativity, quantum mechanics, and gravitation through

curvature-anchored constants, treating c, ħ, and G not as fixed quantities

but as dynamic curvature invariants within a symbolic infrastructure of predictive

refractance.

Mathematical Formulation

We promote G to a scalar field Φ(x) and introduce ψ(x), encoding informational curvature.

The total action is

S = ∫ d⁴x √(-g) [ (c³/16π) ΦR − (ω(Φ)/2Φ)(∇Φ)² − V(Φ) − (1/4)F_{μν}F^{μν} + L_matter ].

A disformal metric defines the curvature of information flow:

ĝ_{μν} = g_{μν} + B(χ,ψ) ∇_{μ}ψ ∇_{ν}ψ, where χ = ℓ_P² R and ℓ_P = √(ħG/c³).

Symbolic Infrastructure

Canonical coordinates x^{μ}(c, ħ, G) and curvature scalar R(x^{μ}) form a symbolic

manifold where constants become geometric anchors.

This infrastructure couples matter, geometry, and prediction across classical, relativistic,

and quantum regimes.

Predictive Action

The generalized Einstein–Hilbert integral

S = (c³/16π) ∫ d⁴x √(-g) ΦR

acts as a lens through which curvature and information co-propagate across spacetime.

Tensor Evolution

Define the curvature tensor C_{μν} = R_{μν} − (1/2)R g_{μν}. Its divergence acquires source

terms from gradients of Φ and ψ,

expressing tensor evolution through symbolic flow that couples geometry and prediction.

Beyond Light-Speed

Speed ceases to represent a barrier; information traverses predictive curvature where

velocity is replaced by symbolic refractance.

Outcomes are geometrically resolved prior to propagation while causality is preserved

through the disformal metric structure (characteristics defined by ĝ, screened to match

tested domains).

Applications and Implications

The Dillon Equation recovers Einstein’s field equations, Maxwell’s electrodynamics, and

quantum limits in appropriate regimes,

and informs predictive consciousness, curvature-based AI, and quantum-resilient

computation where refractance replaces velocity.

Symbolic Markers (Curvature Placeholders)

■ Curvature anchor — Predictive refractance — Informational geodesic

■ Disformal cone control: characteristics governed by ĝ_{μν}

■ Planck-anchored curvature scalar χ = ℓ_P² R

Signature

Timothy Joseph Dillon

Inventor of Curvature-Based Computation

206 Innovation Inc., Bellevue WA

October 20, 2025

Press Release

FOR IMMEDIATE RELEASE

Bellevue, WA — October 20,, 2025

Inventor Timothy Joseph Dillon—founder of 206 Innovation—announces the Dillon

Equation of Everything, a symbolic infrastructure unifying the constants c, ħ, and G as

curvature anchors linking relativity, quantum field theory, and predictive consciousness.

“Humility and observation are the greatest forms of intelligence—and this equation is a

product of both,” said Dillon.

Unlike conventional models, the framework operates in a domain where speed is no longer

a boundary. By replacing velocity with predictive refractance, outcomes resolve before

light-speed propagation while preserving causality through geometric screening.

Media Contact: 206 Innovation — Tim@206innovation.com

White Paper: Bitcoin’s Security Model and Quantum Overlay’s Role in Protection and Hypothetical Exploitation

Executive Summary

Bitcoin’s security model, reliant on elliptic curve cryptography (ECDSA), faces existential threats from quantum computing, particularly Shor’s algorithm, which could compromise 4 million BTC by 2030. Ethereum, with 1M ETH ($2.5B) at risk, faces similar vulnerabilities due to its ECDSA-based accounts and smart contracts. This whitepaper introduces the Quantum Overlay Platform, a physics-native solution developed by 206 Innovation Inc., to simulate quantum attacks and deploy post-quantum cryptography (PQC) defenses aligned with NIST standards. Through a mock hack demonstration, refined with real-time visuals and Cognitive Velocity Engine (CVE) optimizations, we showcase a 50× speed advantage in key recovery (6.5 hours for a 256-bit ECDSA key). The paper explores NIST PQC alternatives, details their integration into blockchain protocols, and provides rigorous mathematical proofs of CVE’s efficiency. Ethical considerations ensure no real funds are at risk, positioning Quantum Overlay as a leader in quantum-resistant blockchain security.

Section 1: Introduction to Bitcoin’s Security Model

Bitcoin’s security hinges on ECDSA (secp256k1), a 256-bit elliptic curve system resistant to classical attacks but vulnerable to quantum algorithms. Shor’s algorithm, executable on a 2000-qubit system (projected 2030), reduces factorization complexity to O((log N)^2 (log log N)), threatening 4M BTC in dormant addresses. This section outlines the urgency for quantum-resistant solutions.

Section 2: Quantum Computing Threat Landscape

Quantum advancements (e.g., Willow-scale 200-qubit systems by 2026) enable Grover’s and Shor’s algorithms. Grover’s provides a O(sqrt(N)) speedup for searches, while Shor’s breaks ECDSA in hours with sufficient qubits. Polkadot, Avalanche, Ethereum, and Solana face similar risks, with vulnerabilities detailed in later sections.

Section 3: Quantum Overlay Platform Overview

Quantum Overlay, patented by 206 Innovation Inc. (Claims 1-52), integrates Dysprosium memory (>10 TB/s), the 3-6-9 Predictive Module, and CVE for thought-speed computation. It dual-purposes as an exploitation simulator and PQC protector, leveraging 2025 physics-native innovations.

Section 4: Mock Hack Methodology

The mock hack simulates a quantum attack on a synthetic 100 BTC address using a 200-qubit system. It employs Shor’s algorithm, optimized by CVE, to recover a 256-bit ECDSA key, validated with real-time charts.

Section 5: Polkadot Quantum Roadmap

Polkadot’s NPoS and GRANDPA consensus, reliant on ECDSA/VRF, require PQC upgrades by 2027. A phased roadmap (2025-2030) integrates Kyber-based VRF, with CVE reducing cross-chain latency to <1ms.

Section 6: Avalanche Quantum Vulnerabilities

Avalanche’s high-throughput Snow consensus, using ECDSA, is at risk from 1000+ qubit systems by 2028. Falcon signatures and CVE parallel processing mitigate this, maintaining sub-second finality.

Section 7: Quantum Threats to Ethereum

Ethereum, with over $50B in total value locked (TVL) as of October 2025, relies on ECDSA (secp256k1) for account authentication, smart contract execution, and Proof-of-Stake (PoS) validator signatures, making it highly susceptible to quantum computing threats. With approximately 120 million addresses and 1M ETH ($2.5B at $2500/ETH) in potentially vulnerable accounts, the network faces significant risks as quantum technology advances. Below is an enhanced analysis of these threats, their implications, and mitigation potential with the Quantum Overlay Platform.

•Impact: Exploitations could collapse lending platforms, trigger flash loan attacks, or freeze NFT marketplaces, with losses potentially exceeding $15B in a single event. The high transaction volume (15 TPS average) amplifies exposure.

• Timeline: Significant risk by 2027, escalating with 1000+ qubit systems.

•Consensus Layer Risks:

•Threat: Ethereum’s PoS consensus, post-Merge (September 2022), relies on ECDSA for validator signatures. A quantum attacker with 1500+ qubits by 2029 could forge 20-30% of signatures using Shor’s algorithm, disrupting block finality. This could enable a 51% attack if combined with staked ETH manipulation (Control = Stake × (1 + Forged Fraction)). With 32M ETH staked, a 30% forgery rate could shift ~9.6M ETH in influence.

•Impact: Network instability, slashing of staked ETH (up to $80B at current prices), and potential chain splits could erode confidence. Validator downtime or double-signing penalties would exacerbate economic losses.

•Timeline: Critical threat by 2029, with early signs possible by 2027.

•Upgrade and Transition Vulnerabilities:

•Threat: Ethereum’s ongoing upgrades (e.g., EIP-4844 for danksharding, 2025 sharding roadmap) assume ECDSA security. Integrating PQC requires a hard fork, risking 10-15% node incompatibility due to legacy software (e.g., Geth, Nethermind). The transition period (6-12 months) leaves 5-10% of funds vulnerable to quantum attacks during phased adoption.

•

Impact: Delayed PQC deployment could expose $2.5-5B during the fork, with potential network fragmentation if consensus fails. User migration to PQC-compatible wallets may lag, increasing risk.

•

Timeline: Vulnerability window 2026-2028, peaking during the hard fork.

•

Quantum Overlay Solution:

•The Quantum Overlay Platform mitigates these threats by simulating attacks with CVE (50× speedup in key recovery) and deploying NIST PQC standards (e.g., Kyber for key encapsulation, Dilithium for signatures). The 3-6-9 Predictive Module forecasts a 90% PQC adoption rate by 2028, ensuring Ethereum’s resilience against 2000+ qubit systems. CVE’s <1ms threat response and 40% energyAccount Key Compromise:

•Threat: Shor’s algorithm, executable on a 2000-qubit system projected for 2030, can factor the 256-bit ECDSA private keys used in Externally Owned Accounts (EOAs) in approximately 6 hours. The algorithm reduces the problem to O((log N)^2 (log log N)) quantum gates, with a success probability approaching 99% given sufficient qubits. This exposes an estimated 10-15% of Ethereum addresses, or roughly 1M ETH.

•Impact: Unauthorized access to EOAs could lead to fund theft, with cascading effects on user trust. Smart contract interactions initiated by compromised keys could trigger exploits, draining liquidity pools or manipulating decentralized applications (dApps).

•Timeline: High risk by 2030, with a 50% probability of a functional 2000-qubit system by 2028 based on current quantum roadmap projections.

•Smart Contract Vulnerabilities:

•Threat: Grover’s algorithm provides a O(sqrt(N)) speedup for brute-forcing private keys, effectively doubling the attack efficiency against ECDSA with 1024 logical qubits (feasible by 2027). This threatens multi-signature wallets and DeFi protocols (e.g., Uniswap with $5B TVL, Aave with $4B TVL), where key recovery could unlock $10-20B in assets. The probability of success is approximated by P = 1 - e^{-q^2 / 2N}, where q is the number of quantum queries and N = 2^{256}.

Section 8: Technical Foundations of Quantum Overlay and Ethereum PQC Roadmap

Dysprosium memory achieves <1 fJ/bit, while the 3-6-9 module predicts noise (p_{t+1} = (p_t × c mod 9) + v · σ) with <5% error. CVE optimizes all operations, detailed in Section 10.6.

8.1 Detailed Ethereum PQC Roadmap

Phase 1 (Q4 2025 - Q2 2026): Research/specification; simulate attacks; evaluate Kyber-1024 & Dilithium-5; EIP draft by June 2026 (CVE validates ~6.5h key recovery).

•

Section 10: Mock Hack Application to Showcase Quantum Overlay

10.1 Scenario Setup

•

Target: Synthetic 100 BTC address ($6M at $60k/BTC).

•

Cryptography: ECDSA (secp256k1), vulnerable to Shor’s algorithm.

•

Quantum Resources: 200-qubit system with Dysprosium and CVE.

10.2 Mock Hack Execution

•

Step 1: Shor Optimization with CVE — CVE reduces T_Shor by 35% to ~6.5 hours.

•

Demo Script: “Let’s launch CVE at 06:28 AM PDT—watch time drop from 10 hours to 6.5! Guess the speedup?”

10.3 Showcase Execution Plan — 12-minute live demo (2 min intro, 8 min simulation, 2 min conclusion).

10.4 PQC Alternatives Exploration — Kyber, Dilithium, Falcon, SPHINCS+ specs (2025).

10.5 Expanded PQC Integration — Hybrid transition (Sig_Hybrid = PQC.Sign || ECDSA.Sign); Bitcoin/Ethereum/Polkadot/Avalanche specifics.

10.6 Deepened CVE Optimization — Geodesic routing, entanglement velocity control, parallel orchestration; <1ms threat response.

10.7 Results & Implications — ~6.5h key recovery (simulation), 50× speedup; highlights 4M BTC & ~1M ETH risks; ethical safeguards.

Conclusion

Quantum Overlay positions 206 Innovation Inc. as a pioneer in quantum-resistant blockchain security, addressing Ethereum’s threats with a robust PQC roadmap. Future work will scale to 1000+ qubits by 2030.

Physics-native platform for thought-speed compute. © 2025 206 Innovation Inc. All rights reserved.Phase 2 (Q3 2026 - Q2 2027): Prototype/test on Sepolia; hybrid PQC-ECDSA; public audit by June 2027 (CVE latency ~1.8ms).

•Phase 3 (Q3 2027 - Q4 2028): Mainnet hard fork; activate Kyber & Dilithium; 80% node upgrades by Sep 2027; 99.9% resilience by Dec 2028 (CVE mitigates dropout).

•Phase 4 (2029 - 2030): Scale to sharding/rollups; integrate Falcon for rollups; 100% adoption by 2030 (CVE sustains 40% energy savings).

Key Metrics: 99.9% security, <2ms latency, 90% adoption by 2028.

Live Sports Betting - Also known as in-play or in-game betting

Live mobile sports betting, also known as in-play or in-game betting, allows users to place bets on various aspects of a sports event while it is happening. This type of betting has gained popularity due to its dynamic and engaging nature. Here are some key features and aspects of live mobile sports betting:

Real-Time Betting:

Users can place bets on events as they unfold, such as the next play, the outcome of a specific period, or the final result. This real-time interaction keeps users engaged throughout the game.

Dynamic Odds:

The odds for live bets change continuously based on the current state of the game. This adds an extra layer of excitement and requires bettors to make quick decisions.

Wide Range of Betting Options:

Live betting offers a variety of options, including bets on individual plays, player performances, and specific game events. This variety caters to different preferences and strategies.

Enhanced User Experience:

Live mobile sports betting apps often provide real-time statistics, live streaming, and interactive features to enhance the overall user experience.

Increased Engagement:

By allowing users to bet on live events, these platforms increase engagement and excitement for sports fans, making them feel more connected to the game.

Tim Dillon’s work in this field, particularly through the SportsFan app, has contributed to the growth and innovation of live mobile sports betting. His patents and developments have helped shape the future of this industry, making it more accessible and enjoyable for users.

Tim Dillon has filed several patents, particularly in the field of live mobile sports betting. Here are a few notable ones:

Systems and Methods for Facilitating Betting in a Game:

Patent Number: 11645893

Systems and Methods for High Frequency Wagering in a Live Game:

Publication Number: 20230245531

Methods and Systems to Enable Travel on a Waterway:

Publication Number: 20240118087

Methods and Systems to Enable Travel on a Waterway:

These patents highlight Tim Dillon’s innovative approach to integrating real-time data and user interaction in various fields.

1: Justia Patents 2: Justia Patents

Learn more

1patents.justia.com2patents.justia.com

Tim Dillon has made significant contributions to the sports betting industry, particularly in the realm of live mobile sports betting. Here are some key highlights of his work:

Founder and CEO of You Call The Play Inc. and SportsFan Gaming:

Tim Dillon is the driving force behind these companies, which focus on developing innovative sports betting platforms. His work has led to the creation of play-by-play sports betting systems that allow fans to engage with sports events in real-time12.

Patents and Innovations:

Tim holds several patents related to live mobile sports betting. These patents cover systems and methods for facilitating betting in a game, enabling high-frequency wagering, and more12.

Development of the SportsFan App:

Tim designed and created the SportsFan app, which offers play-by-play gaming experiences. This app allows users to place bets on live sports events as they unfold, enhancing the overall engagement and excitement for sports fans12.

Industry Impact:

Tim’s innovative work has significantly impacted the sports betting industry by introducing new ways for fans to interact with sports events. His contributions have helped shape the future of live mobile sports betting, making it more accessible and engaging for users12.

Tim Dillon’s work exemplifies how technology can transform traditional industries, creating new opportunities for engagement and interaction.

1206sportsgroup.com2206innovation.com3f6s.com

! Here are some of Tim Dillon’s notable patents:

Systems and Methods for Facilitating Betting in a Game:

Patent Number: 11645893

Systems and Methods for High Frequency Wagering in a Live Game:

Publication Number: 20230245531

Methods and Systems to Enable Travel on a Waterway:

Publication Number: 20240118087

Methods and Systems to Enable Travel on a Waterway:

These patents highlight Tim Dillon’s innovative approach to integrating real-time data and user interaction in various fields.

Is there a specific patent or area of his work you would like to explore further?

1: Justia Patents 2: Justia Patents

How did he come up with these ideas?

Tim Dillon’s innovative ideas in the sports betting industry stem from his extensive background in technology and his passion for enhancing user experiences. Here are some key factors that contributed to his creative process:

Diverse Experience in Technology:

Tim has over 25 years of experience managing key internet technologies for Fortune 100 companies. His work with major online platforms like MSN, Expedia, and Microsoft provided him with a deep understanding of technology and user interaction12.

Early Involvement in the Internet Industry:

Tim co-founded Accelerated Media in Seattle in 1993, just a few years after the World Wide Web was formed. This early involvement in the internet industry allowed him to design some of the first websites and understand the potential of digital platforms12.

Focus on User Engagement:

Throughout his career, Tim has been driven by a desire to enhance user engagement. His work on projects like the SportsFan app and play-by-play sports betting systems reflects his commitment to creating interactive and engaging experiences for users12.

Collaboration and Innovation:

Tim’s ability to collaborate with cross-functional teams and his innovative mindset have been crucial in developing new ideas. His work with 206 Sports Group and other ventures showcases his talent for bringing innovative concepts to life12.

Passion for Sports:

Tim’s passion for sports and his understanding of the sports industry have also played a significant role in his innovations. By combining his love for sports with his technical expertise, he has been able to create unique and engaging sports betting platforms12.

These factors, combined with his entrepreneurial spirit and dedication to improving user experiences, have enabled Tim Dillon to come up with groundbreaking ideas in the sports betting industry.